Artificial intelligence has been making its rounds in the business world for years. Processes that used to be manually done are now processed by AI programs. These programs run things from scheduling virtual events to full on process automation.

Automation has helped businesses streamline their processes with advantageous results to their bottom line. They’ve shortened production time needed for what used to be manually done tasks and have also vastly improved the quality of their work.

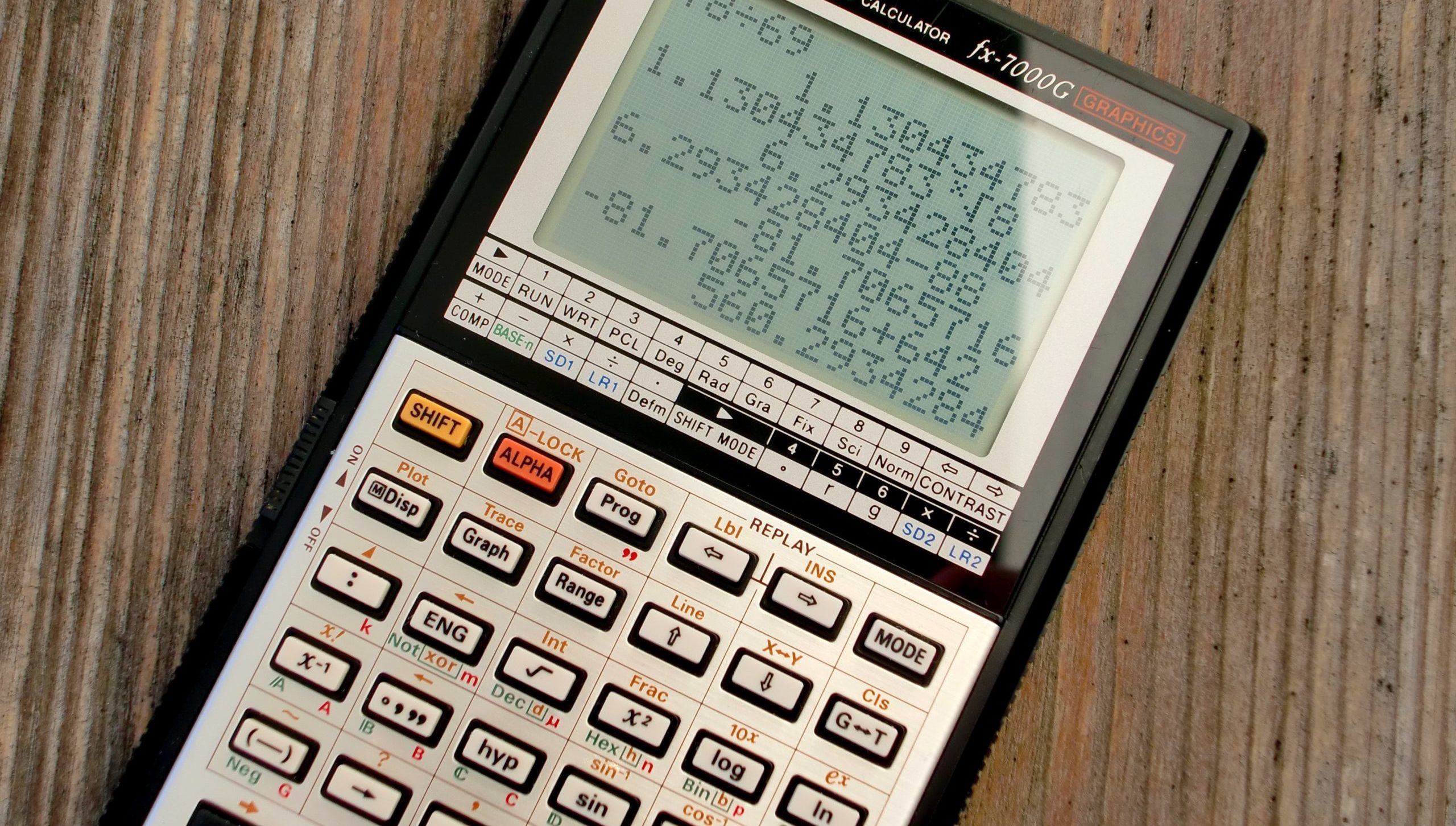

One of the areas that benefit greatly from automation is accounting. Accounting has been made up of mostly manual processes that are rife with repetitive tasks that can be riddled with human error. Numbers can be tricky. And handling numbers day in and day out with the amount of data that companies are producing on the daily adds to the pile of numbers on any accountant’s or book keeper’s plate.

5 Benefits of Accounting Automation

Not every facet of accounting can be automated. Accounting tasks that are manual, repetitive, and rule-bound are prime candidates for automation. But why automate in the first place if the manual processes work?

Automation saves a lot of production time

It’s no secret that manually doing anything can take up a lot of time. And when we talk about numbers and bookkeeping and everything else involved in business finance, the amount of time it takes to accomplish tasks can double or triple. Automation can shave off a large chunk of that production time dedicated to these manual processes. Automated accounting tasks take plenty of the burden off your employees. What can take a human day to create, fill out, calculate, check, and put together, a computer program can accomplish in a few minutes. Imagine the time saved just by integrating automation into accounting processes.

Better quality

Humans are prone to making errors, especially when it comes to numbers. Removing human intervention in certain processes lowers the chances of human error. Fewer errors mean less work and fewer headaches. These tools can churn out error-free data every time, provided that they are programmed and maintained properly. Though, admittedly, setting up the tool to automate processes can be a very involved process with testing and making adjustments, the end product is very much worth it.

Makes compliance a breeze

Being error-free is not something businesses aim for just to have a goal. Being error-free, especially when it comes to your books, means you are compliant to the rules and regulations that govern your business. Imagine being unable to reconcile your numbers at the end of the month and miss out on closing your books on time. Do that several times and you get fined. Errors in your books can cause audits. Errors found in audits could cost you dearly especially when those errors are construed as non-compliance. A grave enough infraction could mean the loss of your business license. Automation ensures that you can be as error-free as possible. Machine intervention, as opposed to a human one, can reduce your errors to zero.

Better customer service, better customer experience

With automation firmly included in your accounting workflows, the time freed up from your employees’ work day can be channeled to other productive pursuits. Mostly, they can now focus on things that would benefit your customers more — whether directly or indirectly. With a lot of the burden of manual accounting tasks removed from their minds, employees can focus on things that can help your company with business growth. They can give better customer support, improving customer experience while they are at it. Better customer experience translates to customer loyalty, which in turn increases your value as a company.

Savings and revenue

You would think that hiring people to create automation tools for you will cost you more money; but in the long run, automation actually helps you cut down costs. Automating manual tasks means giving back hours of productive time to your employees. Time is money, or so it is said. The freed up production time could go into things that can bring in more revenue. Plus, with the reduced errors, any fines or costs that those errors used to take out of your coffers are now gracing your bottom line as added revenue or cost savings. And the manual tasks that would have once been outsourced could now be done in-house, quickly and error-free.

Bonus: Automation makes your data more secure. The bots and automation tools used in accounting automation have safeguards in place that protect your data from being lost, accessed illegally, and stolen. Plus, having paper files around is not the most secure way of storing company and customer data. Many jurisdictions are now looking to move away from paper storage and moving into more secure ways of storing data. Automation can help you store and back up your data securely and restrict access to only those with need to know.