The SaaS industry has grown exponentially in the past few years, and founders are constantly thinking of new strategies to keep their businesses thriving in today’s competitive environment. However, as leaders innovate and try new ideas, they may find themselves neglecting one of the most important functions of their business — finance.

Here are 4 of the most common mistakes SaaS founders and CFOs should keep in mind when it comes to finance, along with tips to help you avoid them.

- Hiring before revenue comes in

Recruitment, staffing, and other related payroll expenses account for almost 70-80% of a B2B business’s total costs, which means the timing of your hiring is crucial. Hire too soon, and you’re wasting scarce resources on unproductive positions; hire too late, and you won’t be able to make sales when they’re most needed.

To mitigate this risk, serial entrepreneur and VC David Skok suggests prioritizing the timely hiring of sales reps, since it’s almost impossible to hit sales targets without an adequately staffed sales team. “Founders are used to the feeling that it’s okay to be a little late with hiring as you’ll save some cash,” notes Skok in his article. “But in the third phase [of the startup lifecycle], hiring misses turn out to be an execution failure that have direct and significant consequences.” By focusing on the recruitment of talented sales staff, you can ensure that your company will be positioned for success when you are ready to scale rapidly.

- Relying on a month-to-month billing model

Relying solely on a monthly pricing strategy increases churn and may waste the resources you’ve allotted for customer acquisition. The solution? Quarterly or annual subscription plans.

An annual pricing model can provide significant benefits to a company, such as an increase in cash flow that you can reinvest in other parts of your business, improved net revenue retention, and reduced A/R collections.

If monthly subscriptions are still a strong selling point for your company, consider offering special discounts on the annual subscription to make it more appealing to customers. An example of a reinforced annual pricing strategy is that of software provider Podio, where they highlight the amount customers can save when opting for an annual subscription through an easy-to-use toggle switch.

- Misalignment between your business needs and accounting method

When many companies are first created, oftentimes they will rely on cash-basis accounting due to its simplicity. And while those companies may increase in scale, oftentimes the switch to accrual can get overlooked or deprioritized — and it may be costing you.

KPI Sense COO Jen Happ recommends considering the following questions to determine if you should switch to an accrual from cash-basis:

- Are you using a cash-basis accounting for your financials?

- Are you seeing a profitable year ahead for your business?

- Are you selling annual subscriptions that require upfront payment?

- Have you been projecting a steady annual revenue growth?

Have you replied ‘yes’ to any of the questions above? Then an accrual-based accounting may be the better choice for you if you want to save on taxes. Suppose you earned $15,000 in June 2020 from an annual subscription paid upfront.

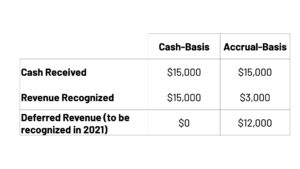

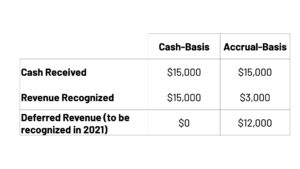

Using the same chart that Jen illustrated, the calculation would probably look like this:

The table above shows that in 2020, you’ll recognize the full revenue amount of $15,000 under cash-based accounting. On the other hand, under accrual accounting, you will recognize only $3,000 of that and defer the remaining amount to be recognized the following year. This means that when you pay your taxes for 2020, the tax rates would be based on the full $15,000 under cash basis accounting, whereas under accrual basis accounting, your tax rate would only be based on the $3,000 revenue you recognized.

By deferring the additional tax until the following year, you can free up significant amounts of capital for reinvestment into your business when attempting to scale And, an added benefit is that your financial statements will be more attractive to banks and investors as you seek to raise capital.

- Not exploring other funding options

Seeking funding from venture capital is a common trend among startups, especially as global venture investments hit an all-time high early this year. While the thought of VC investment may seem attractive, it doesn’t mean this is always the best option for a growing company. These are some of the alternatives:

- Private equity funding

- Additional funding rounds from existing investors

- Angel investments

- Government grants

- Debt markets (advisable only for financially-sound businesses)

Be sure that the funding option you will choose is aligned with your business’s growth phase, and always, always make sure to have a backup plan in place!

Final Thoughts

The good news is, the problems listed above are highly solvable. Prudent cultivation of human resources, thoughtful development of product pricing, and sound financial planning are all achievable goals. That being said, they are easy to forget about, and often overlooked as executives become occupied with the myriad challenges that arise when scaling their business. Keeping the topics above in mind can help you build a firm foundation from which you company can achieve rapid growth.

Photography by Austin Distel via Unsplash.